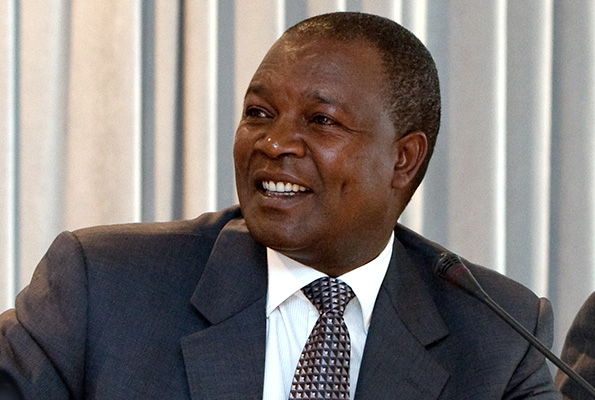

President William Ruto has proposed Njuguna Ndung’u to lead Kenya’s National Treasury. Njuguna Ndung’u served as the governor of the Central Bank of Kenya for eight years, from 2007 to 2015, and is a professor at the University of Nairobi.

Njuguna Ndung’u has significant knowledge of macroeconomics, including unemployment, national income, and the effects of inflation on economic growth.

If the Parliament accepts his nomination, Njuguna Ndung’u will oversee the Treasury under challenging conditions. The nation has just recently recovered from bitter electoral campaigns. However, it also has economic difficulties.

Government expenditure is outpacing its income, inflation is rising, and the value of the shilling relative to other major currencies is plummeting.

Njuguna Ndung’u faces a challenging task. William Ruto ran for office on a platform of fixing the economy and giving low-income people growth benefits.

What does he bring to the position?

Njuguna Ndung’u must make William Ruto’s bottom-up economic approach function. Focus on those at the bottom of the pyramid who lack funds and entrepreneurial chances. Empowering this part of society should create more jobs and raise living standards. This concept contrasts with trickle-down economics, which sends resources to a few at the “top” to flow to the people.

Njuguna Ndung’u worked at the Kenya Institute of Public Policy Research and Analysis, which advises government agencies on policy. In 2001, he helped design a macroeconomic model for Kenya.

He was central bank governor in 2008 when post-election violence and the global financial crisis crippled Kenya’s economy. After that, he was a member of Kibaki’s National Economic and Social Council.

His central banker experience may be his most beneficial for this task. His new job is budgetary policy (spending, tax and debt).

He’ll cooperate with the central bank to avoid fiscal actions that affect monetary measures (like interest rates). Harmony between fiscal and monetary policies aids currency stability (as the UK finds out).

Njuguna Ndung’u has promoted financial inclusion through mobile banking. This means cheap payments, savings, credit, and insurance.

He was courageous to get banks to accept mobile money, which was unpopular. This may drive bottom-up economics. Bottom-up economics requires institutional reforms, and resistance is expected. Kenyans use trickle-down economics.

What’s missing in his toolbox?

Njuguna Ndung’u lacks political experience in a political Cabinet. As Uhuru Kenyatta’s first term proved, technocrats sometimes struggle to integrate into a new political system. Even in technical occupations, politics is essential. Kenyatta lost political clout because his technocratic Cabinet lacked the political weight to promote government programs to his constituency.

William Ruto must be careful, too. His Treasury should give free markets a face, but subsidy cuts may be perceived as cruel.