Touch ‘n Go Group and Principal Asset Management recently announced that they are introducing the principal e-Cash Fund, the underlying fund for Touch ‘n Go’s GO+, is now shariah-compliant. The management team also noted that GO+ fund is Malaysia’s first sharia-compliant electronic wallet product.

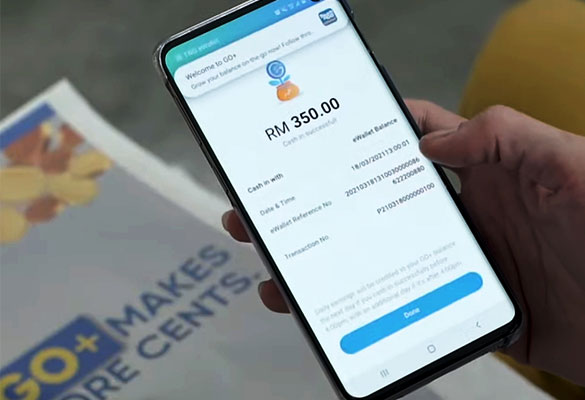

Touch ‘n Go eWallet customers will have access to low-risk money market investments for as low as RM10 and earn the same potential return on a daily basis and be able to use the same money for all transactions over its eWallet. GO+ was launched in March 2021 as Touch ‘n Go’s first step into the area of digital financial services and it is anchored on the Principal e-Cash Fund, a money market fund managed by Principal.

Effendy Shahul Hamid, Group CEO at Touch ‘n Go Group told the media, “When we first launched GO+, there were calls from our users for the underlying fund to be Shariah-compliant. We listened to them and immediately went to work. We now have a product that is even more inclusive than it was, and perfectly in line with our goals of bringing basic financial services to everyone.”

CEO of Principal Asset Management Munirah Khairuddin said since the Principal e-Cash Fund is shariah-compliant, customers can start their investing journey with as little as RM10 and with the same potential return. Principal asset management is the leading Islamic asset manager in Malaysia, among the top five global Islamic asset managers. The company is also at the forefront of developing new Shariah-compliant products and solutions in the global market.