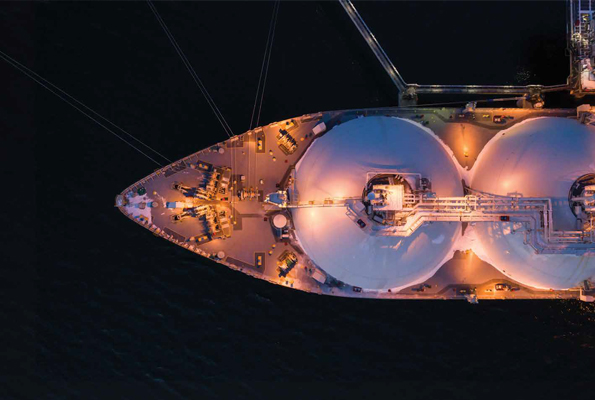

The Maran Gas Achilles vessel, carrying the first Liquefied Natural Gas (LNG) shipment to Vietnam, entered the Thi Vai LNG terminal in July 2023, thus marking the first, and according to the Vietnam Gas Corporation, the most important event in the venture’s green energy transformation roadmap.

Yes, the incident was indeed a milestone for the energy-hungry Southeast Asian country, and the country has drawn up an ambitious energy transformation plan called PDP8, but not everything is hunky dory on the ground. This article will discuss the issue further.

Knowing the LNG sector in detail

Vietnam has put LNG at the centre of its Power Development Plan 8 (PDP8), in order to drastically reduce the Southeast Asian country’s reliance on coal.

PDP8 (which stands for Vietnam’s eighth national power development plan) has set out the country’s electricity roadmap till 2030, with a vision of generating a significant amount of clean energy by 2045, as part of its decarbonisation efforts announced at the 2021 COP26 Summit.

Under the plan, Vietnam’s total electricity generation capacity will increase to 150GW by 2030 from 69GW in 2020. Renewable energy will account for almost 50% of the energy mix by 2030.

LNG will account for 24.8% of the energy mix (37.33GW) by 2030, a fourfold increase from the 9GW of capacity in 2020. This capacity increase will come from 13 LNG projects within Vietnam, expected to go into operation by 2030. This will be further backed by an additional 3,000MW LNG infusion by 2035.

The renewable energy mix may further increase to 66.5% if the Vietnam Just Energy Transition Partnership (JTEP) pledges are fully implemented. Stakeholders like the European Union, the United Kingdom, France, Germany, the United States, Italy, Canada, Japan, Norway and Denmark have committed to providing the Southeast Asian country with funding of $15.5 billion by 2028 to help Vietnam to meet its decarbonisation targets.

“There is a plan to put in place a fuel-to-hydrogen conversion roadmap when the technology is commercialised and costs are more affordable, with a 2050 fuel-switch target of 7,030 MW for gas plants and between 16,400-20,900 MW for LNG plants,” remarked a report from the Mayer Brown.

Coal, however, will continue to play a key role in Vietnam’s energy mix on a reduced basis, accounting for 20% by 2030, with the country trying to eradicate this energy source from its economy by 2050. It’s an expensive process, with the Pham Minh Chinh government predicting that overall funding of $658 billion is required.

Vietnam also has a commitment to import 5,000 MW of capacity from Laos by 2030, and it may increase to 8,000 MW by 2050. The two countries have also announced the big-ticket 600MW cross-border Wind power project, from which electricity will be sold to Vietnam Electricity (EVN).

Vietnam has also committed to building transmission grids, apart from accelerating the smart grid construction works.

“Overall the Government estimates $134.7 billion of new funding will be required for the construction of new power plants and grid infrastructure provided for in PDP8, part of which is expected to come from foreign investors,” noted the Mayer Brown assessment.

As of 2023, Vietnam’s domestic LNG projects produce just 7 billion m3 per year of usable gas which, in the opinion of the analysts, is not enough to fulfil the Southeast Asian country’s current needs.

Vietnam heavily relies on energy imports. In 2018, the Southeast Asian country imported 55% of the total LNG used domestically and by 2020 the same number had grown to 70%.

According to Vietnam’s gas industry development plan, the country will need to import one to four billion cubic metres (m3) of LNG per year from 2021-2025 and that will then increase to six to 10 billion m3 per year by 2026.

Also, since imported LNG fuel comes at a volatile price, any geopolitical crisis will ensure that the product prices will shoot up the skies. As Russia attacked Ukraine in 2022, LNG prices went up in the Southeast Asian country.

State-owned PV GAS operates, which works as a subsidiary of PetroVietnam (the national oil and gas company of Vietnam), is entrusted with the responsibility of exploring, producing, processing, transporting, and distributing LNG products in the domestic market. PV GAS also has strategic pacts with Tokyo Gas Asia, Shell and AES Investment Company.

Vietnam is also eyeing the LNG reserves in the South China Sea, amid its geopolitical tensions with Beijing. The Southeast Asian country is right now producing the LNG in blocks in this area, but most of these facilities are close to the areas where Chinese coast guard ships and research vessels frequently sail, thus causing confrontations.

PDP8 has roadblocks as well

Analysts are eyeing PDP8 as a growth boost to Vietnam’s LNG market, in terms of investments and infrastructures. However disagreements over pricing, plant construction delays and lack of supply contracts are affecting this ambitious roadmap, industry insiders told Reuters.

The developments have also raised concerns among foreign investors about whether the nation can remain a reliable option to diversify manufacturing away from China.

In a June 2023 poll by the European Chamber of Commerce in Vietnam, half the businesses admitted that the ongoing power crisis had hurt their investment plans, with some of them even considering extreme alternatives like stopping the fund flows on their factories.

While the Southeast Asian country targeted LNG-sourced gas generating up to 22.4GW of power by 2030, enough to power 20 million households and account for nearly 15% of the national power supply, Kaushal Ramesh, an analyst at Oslo-based Rystad Energy, didn’t seem impressed by these lofty ambitions.

While much of Vietnam’s LNG investment efforts have been directed to its southern territories, the northern part remains vulnerable to blackouts.

The first northern plant that would be fuelled by imported LNG won’t start its operation until the second half of 2027, informed Tokyo Gas, the plant’s developer, while interacting with Reuters.

“The first plant due to come online, the Nhon Trach 3 facility being built by state-run PetroVietnam Power (PV Power) near Ho Chi Minh City, is scheduled to begin operation in late 2024. Industry sources say 2026 or 2027 is more realistic,” the report commented further.

The cited reasons behind the delay are the lack of long-term contracts and problems with funding and permit. PV Power is also struggling to agree with grid operator EVN on the purchase volume and prices for electricity generated from its plants running on imported LNG, a product which is now 50% more expensive than domestic gas.

Tokyo Gas, which is building an LNG terminal and a gas plant in northern Quang Ninh province, predicted “hard negotiations” ahead. The 3.2 GW project developed by Singapore-based Delta Offshore Energy, is currently undergoing debt restructuring after defaulting on a $10 million loan from Gulf International Holdings.

PDP8 has presented an ambitious roadmap for Vietnam’s LNG sector, a roadmap which will help the country to expedite its decarbonisation efforts, apart from keeping the sector at the forefront of the Southeast Asian country’s economic transformation, at a time when Hanoi wants to challenge China’s status as the world’s manufacturing hub.

However, roadblocks like disagreements over pricing, plant construction delays and lack of supply contracts are affecting the country’s economic ambitions. A quick redressal of these issues will be crucial here. Just how quick the course correction here will be, that’s the key question as of now.